Insights

Current updates are on our LinkedIn page

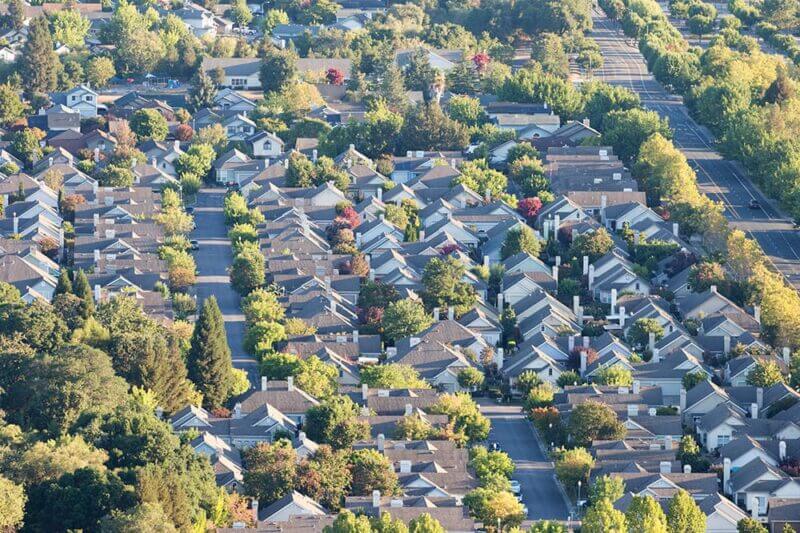

Whitestone & Co. Fund II acquires an additional 110 SFR units

Fund II has acquired 110 additional SFR units in Kansas City, MO. Currently, Fund II has a total of 250 units, with over 170 units under contract and anticipated to close within the next 45 days. To date, Whitestone owns 340 units in Kansas City.

Gino Cozza joins Chris Papa on Impact Real Estate podcast

Gino Cozza chats with Chris Papa on recent episode of the Impact Real Estate podcast. The two discussed how Whitestone is transforming the Section 8 process in Kansas City and why converting single family homes into Section 8 presents an attractive opportunity for investors and the community alike.

Whitestone & Co. Fund II acquires an additional 50 SFR units

Fund II has acquired 50 additional SFR units in Kansas City, MO. Currently, Fund II has a total of 140 units, with over 150 units under contract and anticipated to close within the next 60 days. To date, Whitestone owns 230 units in Kansas City.

Whitestone & Co. Fund II acquires 52 SFR units

Fund II has acquired 52 additional SFR units in Kansas City, MO. Further, the fund has 200+ units under contract that are anticipated to close within the next 60 days. To date, Whitestone owns 148 units in Kansas City.

Burns Single-Family Rent Index Shows U.S. Rents Up 3.8% YOY in September

Demand for single-family rental homes remains robust according to the Burns Single-Family Rent Index. US single-family rents accelerated 3.8% YOY in September, roughly unchanged from August’s 3.9% YOY growth. The index tracks new leases across the 63 largest single-family rental markets in the US.

Whitestone & Co. Launches Real Estate Fund II

Continuing our commitment to bringing residential real estate to income-focused investors, Whitestone has launched its second real estate fund. Fund II builds on the strategy of Fund I by targeting single-family rentals in Kansas City communities within the path of revitalization. Fund II currently boasts a pipeline of 40 homes under contract set to close within the next 75 days.

Whitestone & Co. Real Estate Fund I Now Closed

Whitestone’s initial real estate fund closed with a total of 62 properties totalling 90 units. The strategy of the fund was to acquire affordable single-family rentals in Kansas City communities with strong long term fundamentals at below replacement cost and within the path of revitalization. Our commitment to this strategy is highlighted by the fact that the principals of the firm represent over 50% of the total equity contributed. “We look forward to bringing happiness and better lives to our tenants one home at a time,” said Gino Cozza, Founder and Principal.

Whitestone & Co. Fund II closes first acquisition

The Fund acquired its first three properties located at 1615 E 39th Street, 5345 Olive Street, and 3528 Woodland Avenue in Kansas City, Missouri. The three properties are located within a seven minute drive and in close proximity to Country Club Plaza.