Insights

Current updates are on our LinkedIn page

Investing in Section 8 Housing: A Stable Investment Option in Uncertain Times

Alicia Miller joins the hosts of the Legacy Wealth podcast for a discussion of the benefits of investing in section 8, what makes class-C properties attractive, and the risks and rewards of single-family rental investing.

Whitestone acquires 190 SFR homes in St. Louis, Missouri

Whitestone Real Estate Fund III, LP has acquired a portfolio of 190 homes across north St. Louis County. The portfolio is 97% occupied with 98% of those homes leased to residents with housing choice vouchers.

Intel to build $20B Ohio chip facility amid global shortage

We have always loved Columbus as it is one of our prime housing markets. Having already established ourselves in the Columbus market, there will be a heavy appreciation boost for investors involved with this Intel facility being built.

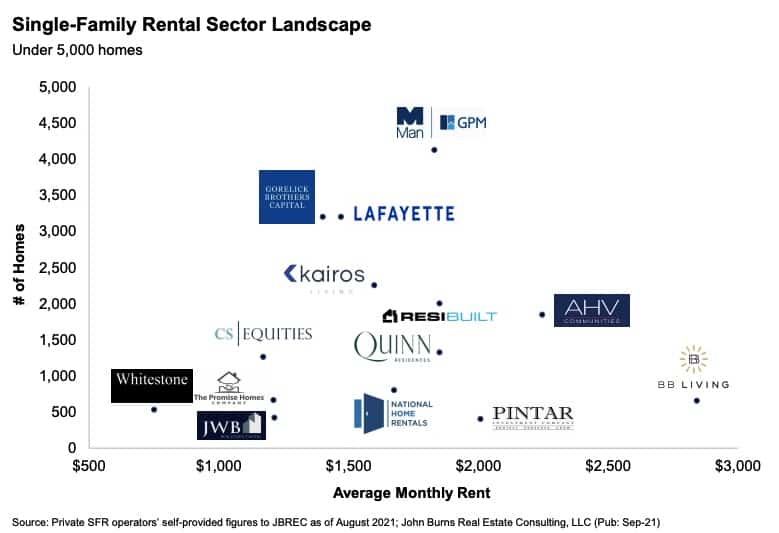

Whitestone Listed as a Top 20 Performing Operator by John Burns Real Estate Consulting

John Burns Real Estate Consulting listed Whitestone as one of its top 20 performing operators in single family rentals. Our philosophy in increasing lower income housing across the midwest markets has allowed us to scale quickly and efficiently, servicing housing to the masses, with infinite tenant demand.

Alicia Miller interviewed about the current institutional trends towards single family rentals in PERE Magazine.

Whitestone & Co. Vice President of Capital Markets Alicia Miller discuss her skepticism towards institutions investing in class-A single family rentals, not only as a competitor in the space, but also as someone who once fit the description of a model tenant in the standard SFR scheme.

Waterfalls and Catch-Ups

Waterfalls and catch-ups are common terms for defining how distribution flows from an investment to the limited partners involved. Essentially, waterfalls and catch-ups portray the overall risk of the investment opportunity, and how much or how little an investor has to gain financially from the investment opportunity. These two videos help to explain.

Whitestone & Co. Fund II acquires an additional 123 SFR units

Fund II has acquired 123 additional SFR units in Kansas City, MO. Currently, Fund II has over 380 units, with over 100 units under contract and anticipated to close within the next 45 days. To date, Whitestone owns 470 units in Kansas City.

Alicia Miller discusses SFR investing on podcast

Whitestone & Co. Vice President of Capital Markets Alicia Miller joins Collin Placke on the “Rigs to Real Estate” podcast.