Whitestone Real Estate Fund IV

Currently raising capital

Funds

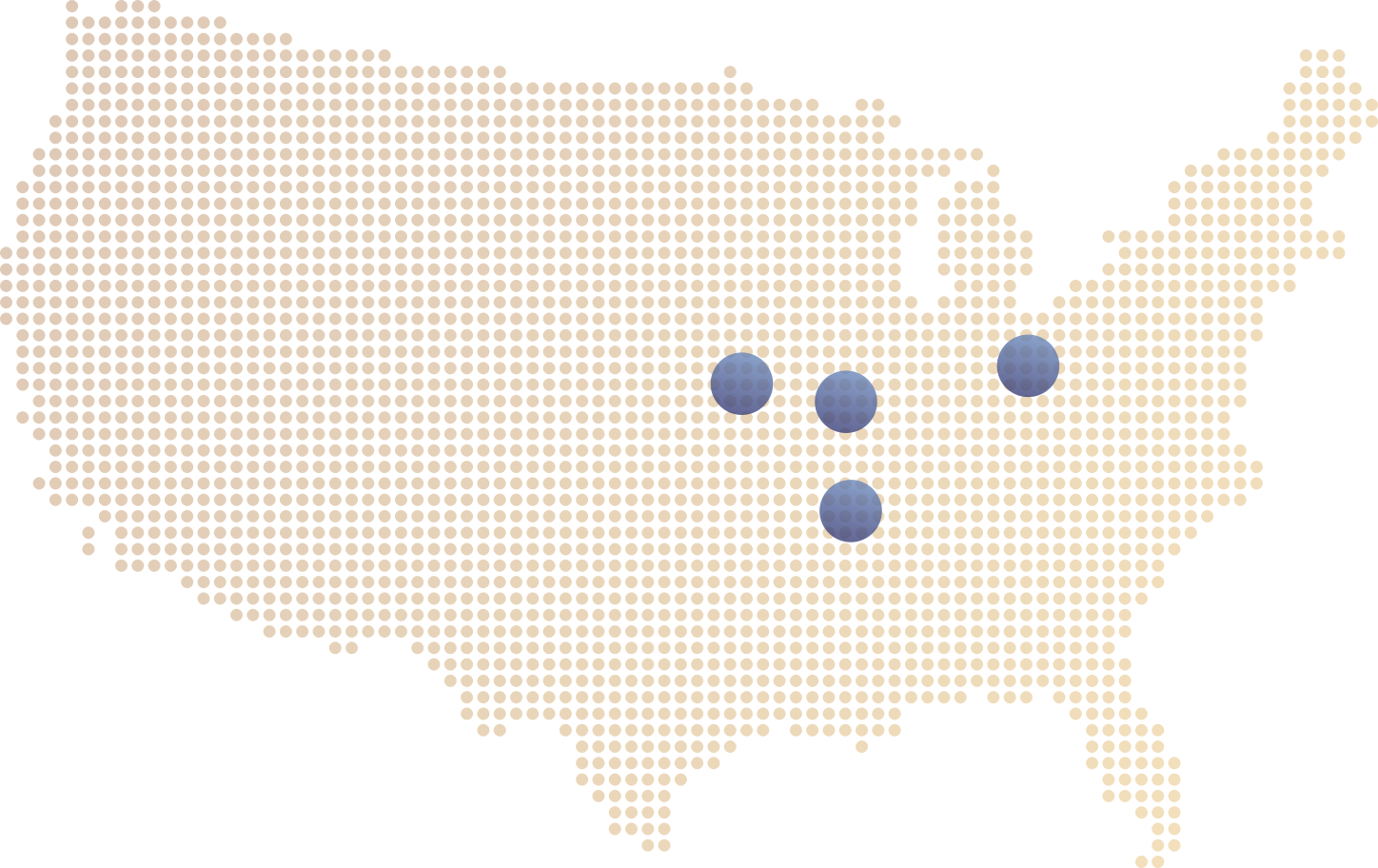

Fund IV target markets

- Asset:

- Single-family rental homes

- Term:

- 7 years

- Minimum Commitment:

- $250,000

- Target Investment:

- Stabilized, income-generating residential properties

- Geographic Focus:

- Kansas City, MO

Memphis, TN

St. Louis, MO

Columbus, OH

Whitestone Real Estate Fund IV

Investment highlights

-

Compelling market opportunity

Strong demand fundamentals given significant housing shortage for voucher holders and newcomers

-

Attractive and stable cash flows

Housing choice voucher holders and resettlement grants provide cash flow stability and insulation from collection risk

-

Successful track record

Highly experienced team building successful real estate platform. Assets managed with infrastructure/processes of established platform

-

Proven investment strategy

We acquire properties below replacement cost and within the path of revitalization

-

Aligned interests

Internal property management team oversees operations and places voucher, newcomer, and market residents